It’s no secret that Capital IQ (commonly referred to as CapIQ in the industry) is a pioneer in the financial data industry. Since its founding in 1998, Capital IQ has grown into a leading provider of global financial data used by thousands of finance professionals across the globe. Today, Capital IQ is owned by S&P Global and is now being called Market Intelligence.

Here is the corporate timeline for Capital IQ:

- 1998: Founded by Steve Turner, Randal Winn, and Neal Goldman.

- 2003: Acquires Simply Stocks to add public company financials.

- 2004: Acquired by McGraw-Hill for more than $200 million.

- 2015: Acquires SNL Financial for $2.2 billion.

- 2016: Rebrands as S&P Global Market Intelligence.

What Does Capital IQ Offer

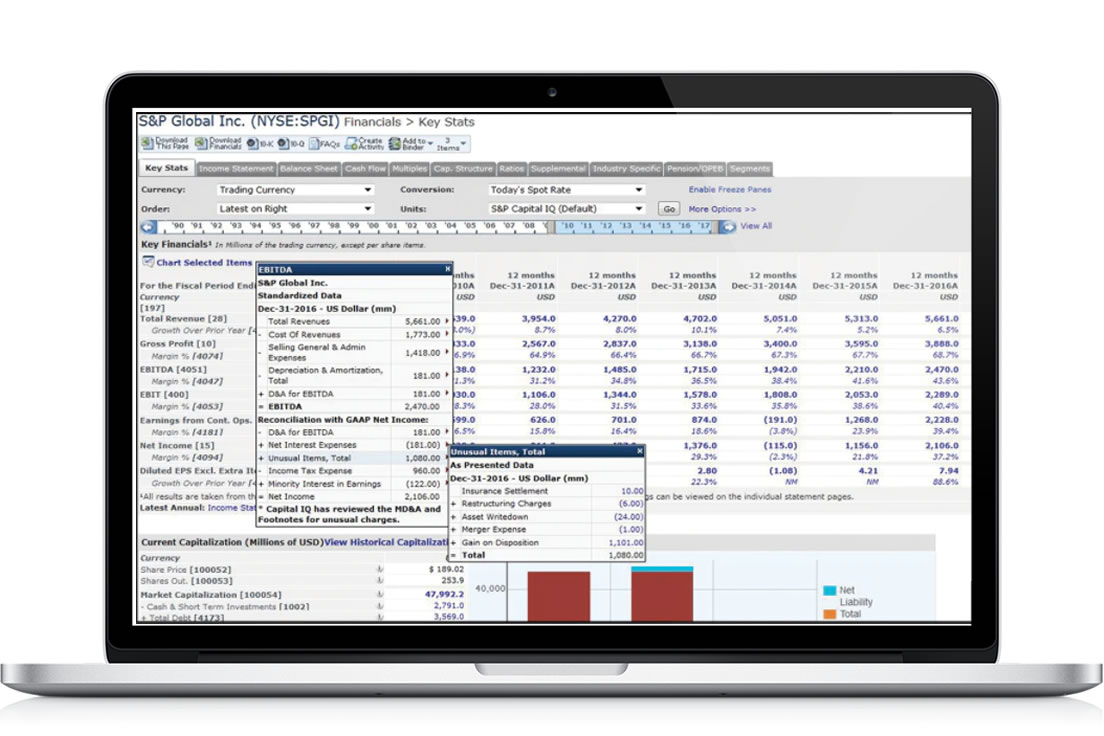

Since launching in 1998, Capital IQ has received significant scale as a provider of global financial data with over 13,000 employees listed on LinkedIn. They started out with a focus on investment banking and quickly expanded to support other professionals such as portfolio managers and investment analysts. Today, Capital IQ offers the following data on their platform:

- Public Company Financials

- M&A Transactions

- Private Company Data (via Dun & Bradstreet)

- Bond Issuances

- Macroeconomic Data

- Company News

- Transcripts

- Equity Research Reports (additional charges apply)

- Commodities

- Ownership

Coverage Universe

Capital IQ is an international database covering 99.9% of the global market capitalization.

Customer Reviews and Feedback

In our conversations with clients using Capital IQ, these are some of the common reasons people like the platform:

- Global coverage

- Access to equity research reports

- Name recognition

- Excel add-in with audit-to-source capabilities

These are some of the reasons why people choose to move away from Capital IQ to other data platforms:

- Expensive subscriptions

- Aggressive annual cost increases

- High cost of API and CRM integrations

- Old-school user interface

- Slow to update smaller company financials

- Treatment of operating leases as debt

- Numbers often change after the analysis date

- Lack of closed-end fund data

- Excel add-in not available for Macs

What Does Capital IQ Cost in 2025?

Capital IQ does not publish their pricing but here are some data points we’ve run across in conversations with some of their clients:

- A CPA firm with 25 users was paying $125,000 per year

- A valuation firm with 400 users was paying $600,000 per year

- A private equity firm with 4 users was paying $75,000 per year

- A CPA firm with 8 users was paying $63,000 per year

- An investment banking firm with 5 users was paying $55,000 per year

How Does TagniFi Compare to Capital IQ?

| TagniFi Value | TagniFi Pro | Capital IQ | |

|---|---|---|---|

| Annual Price | $3,590 | $4,990 | $30,000+ |

| Data | |||

| Public Companies |

✓ |

✓ |

✓ |

| - Financial Statements |

✓ |

✓ |

✓ |

| - Footnotes | ✕ |

✓ |

✕ |

| - Analyst Estimates and Ratings |

✓ |

✓ |

✓ |

| - Executive Bios and Compensation |

✓ |

✓ |

✓ |

| - Insider Transactions |

✓ |

✓ |

✓ |

| Private Companies | ✕ |

✓ |

✓ |

| - Key People Contacts | ✕ |

✓ |

✕ |

| M&A Transactions |

✓ |

✓ |

✓ |

| - Purchase Price Allocations |

✓ |

✓ |

✓ |

| - League Tables |

✓ |

✓ |

✕ |

| Private Equity | ✕ |

✓ |

✓ |

| - Investment Criteria | ✕ |

✓ |

✓ |

| - Portfolio Companies | ✕ |

✓ |

✕ |

| - Team Contacts | ✕ |

✓ |

✕ |

| M&A Advisors | ✕ |

✓ |

✓ |

| - Team Contacts | ✕ |

✓ |

✕ |

| Closed-End Mutual Funds |

✓ |

✓ |

✕ |

| FDIC Banks | ✕ |

✓ |

✕ |

| Economic and Industry Rates |

✓ |

✓ |

✓ |

| Search | |||

| Public Company Searches |

✓ |

✓ |

✓ |

| Private Company Searches | ✕ |

✓ |

✓ |

| M&A Transaction Searches |

✓ |

✓ |

✓ |

| Investor Searches | ✕ |

✓ |

✓ |

| People Searches | ✕ |

✓ |

✕ |

| CSV Exports |

✓ |

✓ |

✕ |

| Portfolio Company Searches | ✕ |

✓ |

✕ |

| Economic Data Searches |

✓ |

✓ |

✕ |

| Excel | |||

| Excel Add-In |

✓ |

✓ |

✓ |

| Function Builder |

✓ |

✓ |

✓ |

| Model Library |

✓ |

✓ |

✕ |

| Save As Values |

✓ |

✓ |

✕ |

| Convert From Values |

✓ |

✓ |

✕ |

| Mac-Friendly |

✓ |

✓ |

✕ |

| Research | |||

| Quarterly Economic Updates | ✕ |

✓ |

✕ |

| Industry Research Reports | ✕ |

✓ |

✕ |

| Equity Research Reports | ✕ | ✕ |

✓ |

| Coverage | |||

| U.S. Market |

✓ |

✓ |

✓ |

| International Markets | ✕ | ✕ |

✓ |

| Support | |||

| Phone and Email Support |

✓ |

✓ |

✓ |

|

Excel Model Conversion1 |

✓ |

✓ |

✕ |

Schedule A Demo

Schedule a live demo to see how TagniFi is helping innovators in your market.