Highlights

“These strategic-financial buyers are much more likely to acquire a company in your client’s industry since they know the market and have the expertise to integrate your client’s company into their existing portfolio company.”

3 Ways to Find the Perfect Middle-Market Buyer

The perfect buyer for your client’s company is out there. You just need to find them. Historically the perfect buyer was assumed to be a strategic buyer since they could justify paying more for the company due to overlapping business operations that presented some synergies – whether through revenue expansion or cost reductions.

With the growth of private equity over the last several decades, financial buyers are increasingly turning into strategic buyers through their vast network of portfolio companies. There are over 40,000 private equity-backed portfolio companies in the United States, many of which are looking for add-on acquisitions to generate additional growth (and returns) for their PE sponsor.

Search M&A Transaction Announcements

Every day there are dozens of M&A transactions announced via press releases or company websites. These announcements typically include descriptions of the companies involved with keywords that can be used to identify the perfect buyer. For example, if you are selling a company in the fire alarm industry located in New York, here is an example of a deal announcement that could be used to find the perfect buyer with a “fire alarm + new york” keyword search (note how the plus sign is used as an AND search):

Pye-Barker Fire & Safety – the largest fully integrated and full-service fire protection, life safety and security services provider in the United States – has acquired Alarm Specialists Inc., a premier security and fire alarms systems provider serving the New York-Connecticut-New Jersey area. Pye-Barker continues to partner with companies that complement the full suite of safety services it provides to an ever-growing customer base. Through purposeful growth, Pye-Barker now has 6,000 team members serving customers across 40 states.

Headquartered north of New York City in White Plains, New York, Alarm Specialists services, installs and designs custom security and fire detection systems, including video surveillance, CCTV, access control, entry systems, smoke and carbon monoxide detectors, fire alarms, and 24-hour emergency monitoring. Since its founding in 1975, the Alarm Specialist team has honed its craft to provide testing and inspections that keep business customers protected and code compliant.

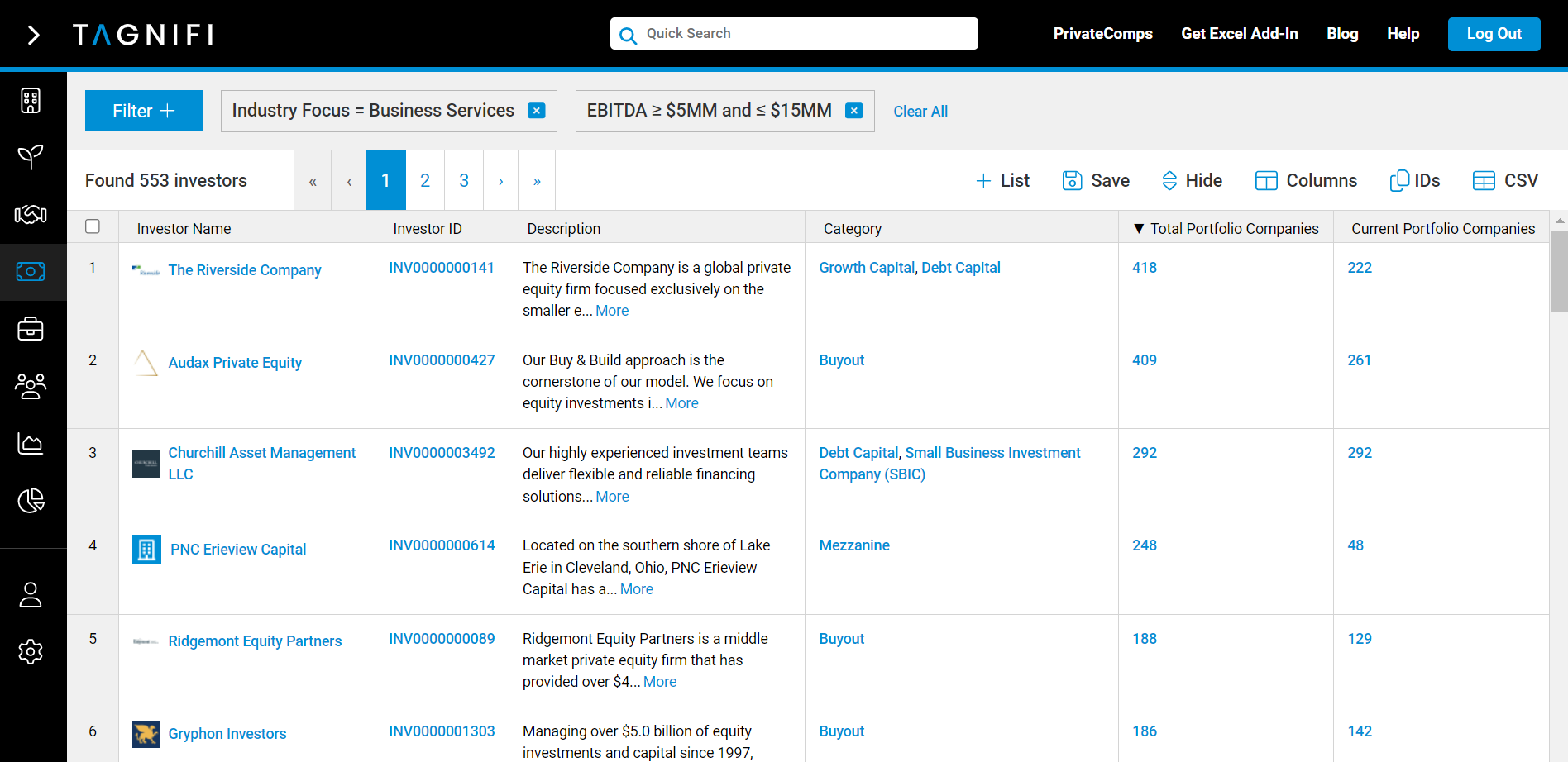

Search Private Equity Profiles

Did you know there are more than 10,000 active private equity investors, family offices, and independent sponsors in the US? Most of these investors post their investment criteria on their website including industry focus, geographic preference, investment size range, and use of capital (ex growth, buyout, recapitalization, etc.). However, going through 10,000 websites would take you forever. The good news is that we’ve done that work for you. TagniFi Pro gives you the ability to search by any of these criteria to identify the list of perfect buyers for your client’s company. For example, if you are looking for a list of private equity firms focused on business services with a target EBITDA range of $5-15 million, simply enter this into the search criteria. There were 533 investors with profiles meeting this criteria. You may not have a perfect buyer, but several of them.

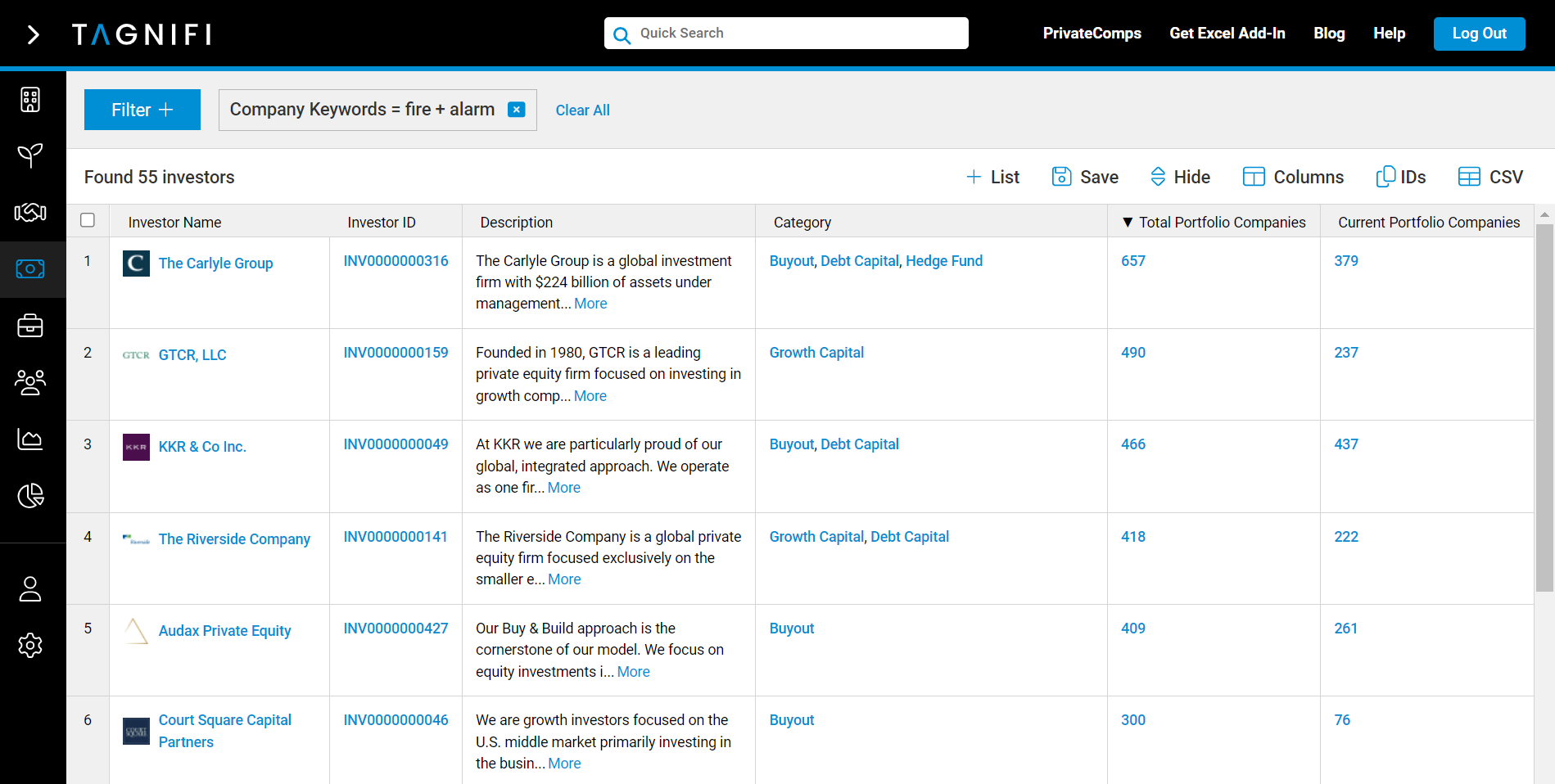

Search Private Equity Portfolios

Knowing a private equity firm’s investment criteria is a powerful tool. Unfortunately, just because an investor says they are looking for opportunities in certain industries does not mean they are the perfect buyer for your client’s company. You might want to refine your search even further to find investors already owning companies in their portfolio that match your client’s company, making them more of a strategic buyer than a financial buyer. These strategic-financial buyers are much more likely to acquire a company in your client’s industry since they know the market and have the expertise to integrate your client’s company into their existing portfolio company.

To run this search on TagniFi Pro, simply add the portfolio company keywords under the Investor search like this:

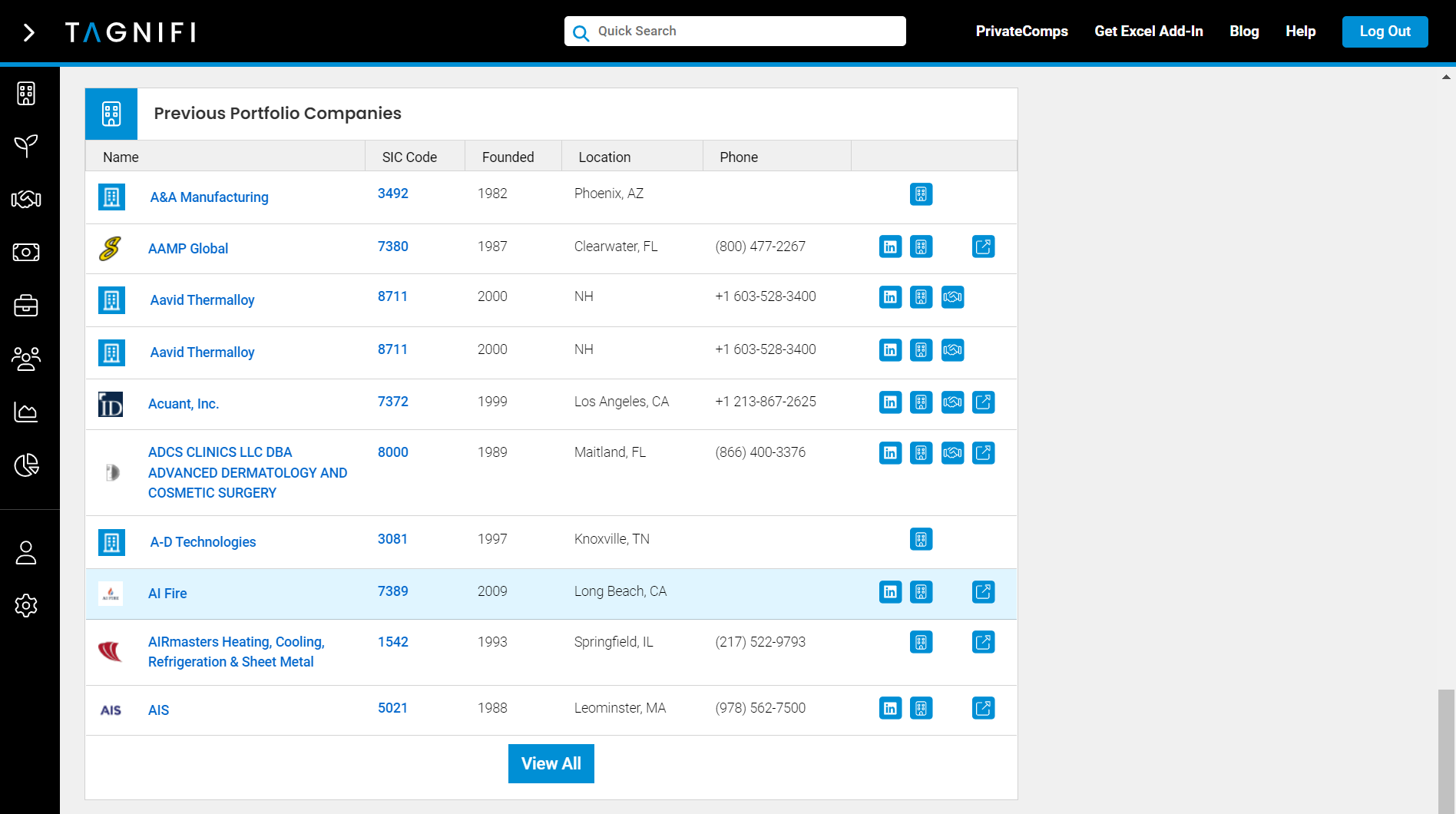

As you can see from the above screenshot, there were 55 private equity firms and family offices that already own something in their portfolio with the keywords fire AND alarm. If you click into any of the investor in the list, the matching portfolio companies will be highlighted in blue like this:

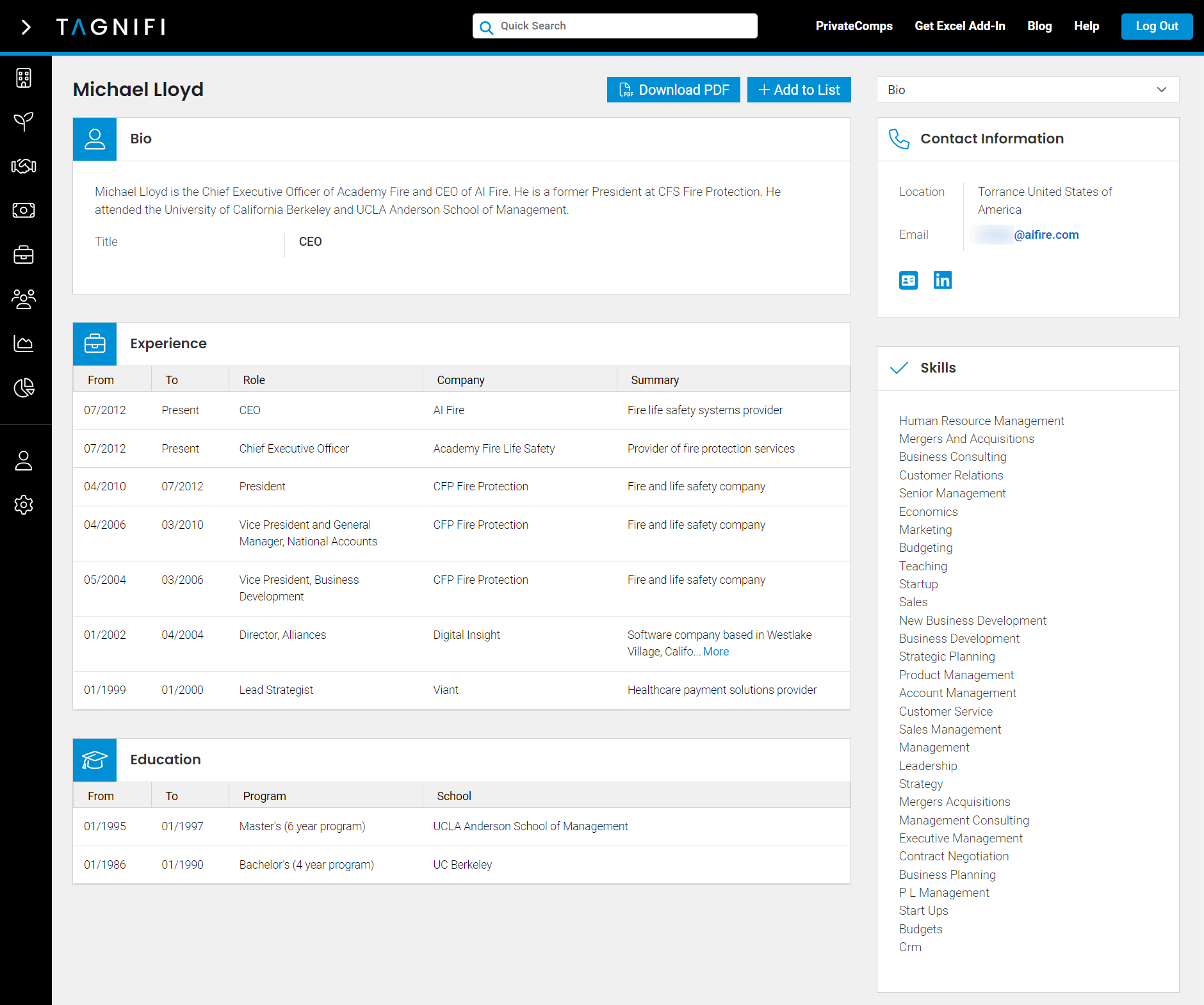

Clicking into the portfolio company will show you the company profile including key people and board members. Here is an example of the CEO’s profile for this fire alarm company, including their email address:

Conclusion

As you can see, finding the perfect buyer for your client’s company is possible with a little searching and research. You can do any of this the old-fashioned way with Google searches and spreadsheets, or you can try TagniFi Pro to find the perfect buyer in minutes.