Since its founding in 2009, PitchBook has become a leader in the financial data industry by building a comprehensive database of venture capital and private equity data. Today, PitchBook is 100% owned by Morningstar and, as of 12/31/2024, it had 10,600 accounts with 125K users on its platform, generating $618 million in annual revenue. Based on these figures, PitchBook’s average revenue per account (ARPA) is $58,300, and its average revenue per user (ARPU) is $4,900.

Here is the corporate timeline for PitchBook:

- 2007: Founded by John Gabbert.

- 2009: Launches the PitchBook Platform.

- 2009: Morningstar invests $4.2 million in PitchBook for an estimated 20% stake.

- 2016: Morningstar acquires the remaining 80% interest in PitchBook for $180 million.

What Does PitchBook Offer

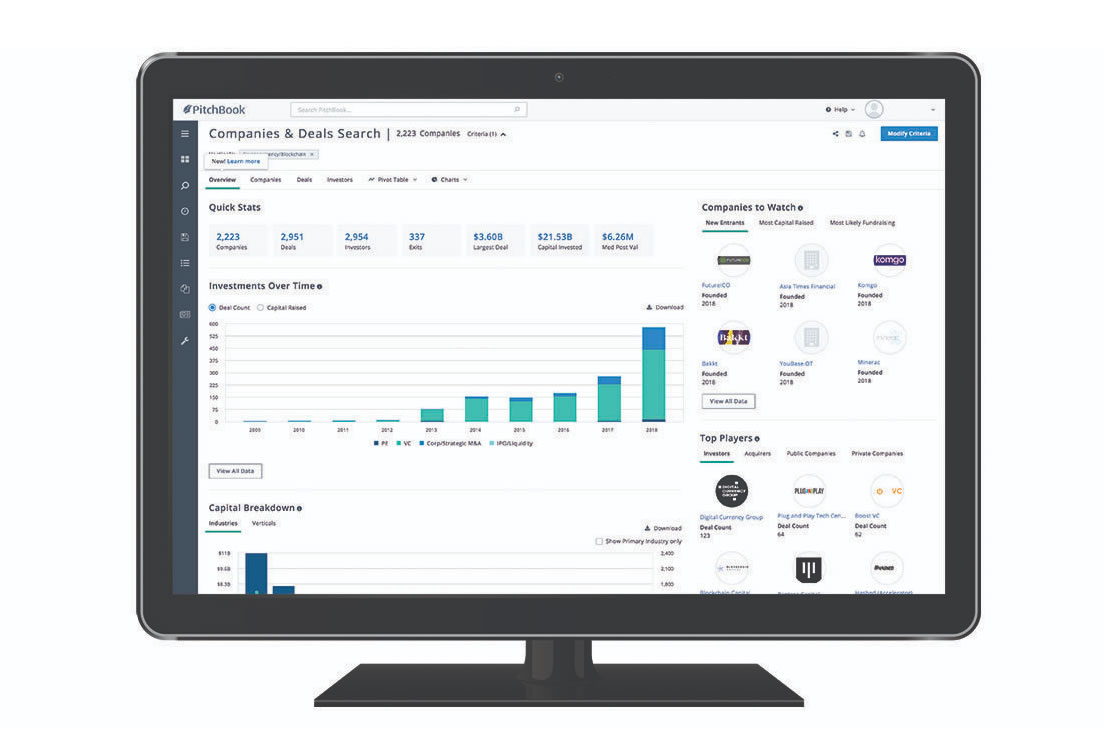

Since launching in 2009, PitchBook has received significant scale as a provider of venture capital and private equity data with over 1,000 employees listed on LinkedIn. The company started out with a focus on venture capital and quickly expanded to support other segments including private equity firms, corporate development, law firms, and universities. Today, PitchBook offers the following data on their platform:

- Venture Capital and Angel Financings

- Private Equity Transactions

- M&A Transactions

- Limited Partner Data

- Fund Raising Data

- Lender Data

- Advisor Data

- Private Company Data

Coverage Universe

PitchBook is an international database. It is not possible to purchase U.S. data separately.

Competitors

PitchBook competes with the following companies in the financial data market:

- CB Insights

- Preqin

- Refinitiv

- S&P Capital IQ

- TagniFi

Customer Reviews and Feedback

In our conversations with clients using PitchBook, these are some of the common reasons people like the platform:

- Venture capital funding data

- Name recognition

- Global coverage

- Salesforce integration

These are some of the reasons why people choose to move away from PitchBook to other data platforms:

- Expensive subscriptions

- Aggressive annual cost increases

- High cost of API and CRM integrations

- Can be difficult to navigate

- Missing lower middle-market transactions

- Lack of easily exportable contact information

- Limitations on the amount of data that can be exported

- Limited Excel add-in functionality

- Errors in public company data

- Public company data is not transparent or point-in-time capable.

What Does PitchBook Cost in 2025?

PitchBook does not publish its pricing but here are some data points we’ve run across in conversations with some of its clients and prospects:

- A credit union was quoted $40,000 for 1 user.

- An investment banking firm with 3 users was paying $32,000 per year.

- A private equity firm with 7 users was paying $60,000 per year.

- An investment banking firm with 5 users was paying $45,000 per year.

- A business valuation firm with 2 users was paying $25,000 per year.

- An investment banking firm with 10 users was paying $70,000 per year.

In addition, PitchBook offers a “solopreneur” plan that runs $20,000 per year for one user.

How Does TagniFi Compare to PitchBook?

| TagniFi Value | TagniFi Pro | PitchBook | |

|---|---|---|---|

| Annual Price | $3,590 | $4,990 | $25,000+ |

| Data | |||

| Public Companies |

✓ |

✓ |

✓ |

| M&A Transactions |

✓ |

✓ |

✓ |

| Private Equity | ✕ |

✓ |

✓ |

| Team Bios | ✕ |

✓ |

✓ |

| Key Executives | ✕ |

✓ |

✓ |

| M&A Advisors | ✕ |

✓ |

✓ |

| Private Companies | ✕ |

✓ |

✓ |

| Closed-End Mutual Funds |

✓ |

✓ |

✕ |

| Analyst Estimates |

✓ |

✓ |

✓ |

| FDIC Bank Call Reports | ✕ |

✓ |

✕ |

| Economic Data and Interest Rates |

✓ |

✓ |

✕ |

| Search | |||

| Company Searches |

✓ |

✓ |

✓ |

| M&A Transaction Searches |

✓ |

✓ |

✓ |

| Investor Searches | ✕ |

✓ |

✓ |

| People Searches | ✕ |

✓ |

✓ |

| Portfolio Company Searches | ✕ |

✓ |

✓ |

| Economic Data Searches |

✓ |

✓ |

✕ |

| Excel | |||

| Excel Add-In |

✓ |

✓ |

✓ |

| Function Builder |

✓ |

✓ |

✓ |

| Model Library |

✓ |

✓ |

✓ |

| Save As Values |

✓ |

✓ |

✕ |

| Convert From Values |

✓ |

✓ |

✕ |

| Coverage | |||

| U.S. Market |

✓ |

✓ |

✓ |

| International Markets | ✕ | ✕ |

✓ |

| Support | |||

| Phone and Email Support |

✓ |

✓ |

✓ |

|

Excel Model Conversion1 |

✓ |

✓ |

✓ |

| Free Quarterly Economic Updates |

✓ |

✓ |

✓ |

| 1 - Additional charges may apply. |

Schedule A Demo To See How TagniFi Compares

Schedule a live demo to see how TagniFi is helping innovators in your market.