Highlights

“Investors who neglect the footnotes might miss out on critical information that could impact their investment decisions, whereas those who rely solely on footnotes might get bogged down in details without grasping the bigger picture.”

Financial Statements vs. Footnotes: Which Is The Champ?

When it comes to evaluating a company’s financial health, investors, analysts, and stakeholders often rely on the information provided in the company’s financial documents. Two of the most crucial components of these documents are the financial statements and the footnotes. Each offers unique insights and serves specific purposes in the financial analysis of a company. Understanding the benefits and challenges of using each can significantly enhance the accuracy and depth of any financial analysis.

The Power of Financial Statements

Financial statements—comprising the balance sheet, income statement, and cash flow statement—provide a snapshot of a company’s financial status at a given point in time. They are the first go-to sources for assessing a company’s profitability, liquidity, and financial stability.

Benefits:

- Clarity and Standardization: Financial statements are structured according to standard accounting principles, such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). This standardization helps ensure clarity and consistency, making it easier for analysts to compare the financial health of different companies objectively.

- Overview of Financial Health: These statements offer a clear picture of a company’s operational efficiency, displaying how well it generates revenue and manages its expenses and liabilities over a specific period.

- Trend Analysis: Analysts can use multiple periods of financial statements to identify trends, assess performance over time, and make predictions about future performance.

Challenges:

- Lack of Detail: While financial statements provide a comprehensive overview, they often lack detailed explanations of the numbers. This can lead to misinterpretations, especially if the figures are influenced by non-recurring events or accounting changes.

- Potential for Manipulation: Companies might use creative accounting techniques to alter their financial results, making them appear more favorable. This can mislead stakeholders about the true financial condition of the business.

The Insightfulness of Footnotes

Footnotes in financial reporting are the explanatory notes attached to the financial statements. They provide context and details behind the figures presented in the main parts of the financial statements.

Benefits:

- Detailed Information: Footnotes can reveal in-depth details about accounting policies, assumptions, and estimates used in preparing the financial statements. This can include information on depreciation methods, inventory valuation, and pension liabilities, among others.

- Disclosure of Contingent Liabilities and Risks: They often include critical disclosures about potential liabilities, litigation risks, and other off-balance sheet items that are crucial for a full understanding of financial risks.

- Insight into Management’s Judgments: Footnotes can provide insight into management’s judgment and flexibility in applying accounting principles, offering a deeper look into the strategic decisions made by the company.

Challenges:

- Complexity and Volume: The information within footnotes can be voluminous and complex, making it challenging for even seasoned analysts to interpret.

- Inconsistencies: While financial statements are standardized, the content and presentation of footnotes can vary significantly between companies, making comparisons difficult.

- Overlooked by Users: Due to their complexity and the effort required to understand them, footnotes are often underutilized by casual investors, who may miss out on crucial details necessary for a thorough analysis.

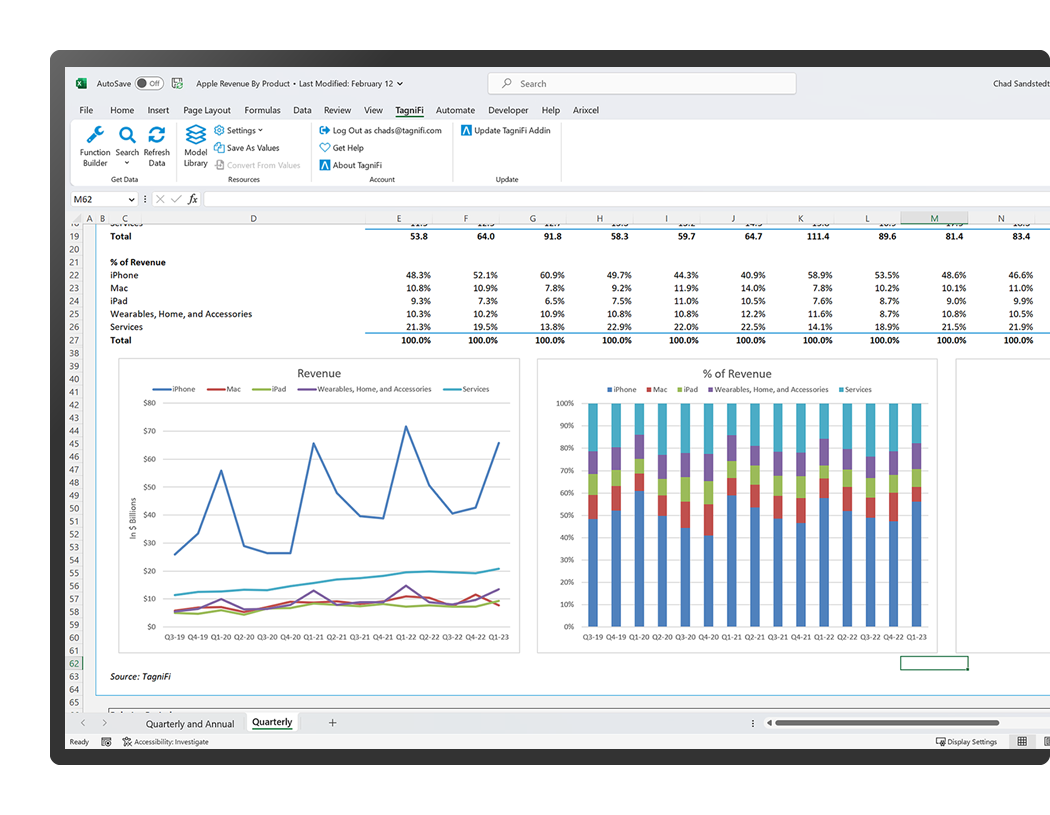

TagniFi has two datasets that can help you take your analysis to the next level when analyzing financial statements and footnotes.

TagniFi Fundamentals is a standardized financial statement database with over 1,000 tags on the income statement, balance sheet, and cash flow statement. It is the perfect blend of standardized data for comparing companies side-by-side with enough detail to see the important line items for each financial statement. Paired with the TagniFi Excel Add-In, you can run any public company through the same Excel model to streamline and automate your analysis process.

TagniFi Footnotes is a footnote and as-reported database with detailed tagging for every footnote item and as-reported financial statement line item. It is perfect for comparing a company’s performance over time using their as-reported line items and footnotes. It is also available in the TagniFi Excel Add-In (Pro plans only) For example, you can model a company’s revenue by business or geographic segment over time. Another popular use case for this data is to analyze lease and pension obligations to see the real off-balance sheet liabilities of a company.

A Split Decision

Both financial statements and footnotes are integral for a comprehensive analysis of a company. Financial statements offer a bird’s-eye view of the financial health of a company, while footnotes provide the necessary context and detail that can uncover deeper insights or potential red flags. The choice between focusing on financial statements or footnotes—or, more wisely, the decision to integrate both into one’s analysis—depends on the specific objectives and depth of analysis required. Investors who neglect the footnotes might miss out on critical information that could impact their investment decisions, whereas those who rely solely on footnotes might get bogged down in details without grasping the bigger picture. Thus, a balanced approach, leveraging the strengths of each while being mindful of their limitations, is essential for a robust financial analysis.