Highlights

“The TagniFi Investors database is a powerful tool for identifying financial buyers by their stated investment criteria including, size preference, industry focus, geographic focus, and more.”

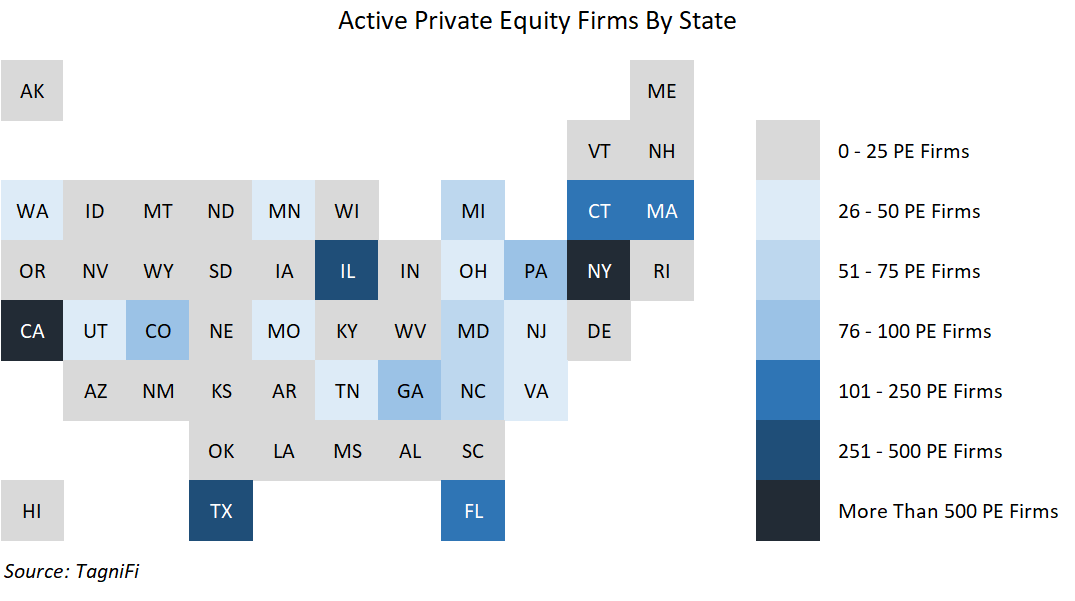

Active Private Equity Firms By State

We’ve searched the TagniFi Investors database to see which states have the most active private equity firms. Private equity is a broad area of finance, ranging from buyouts to mezzanine capital and everything between. Here are all of the categories with private equity activity covered in TagniFi:

- Buyout

- Growth Capital

- Venture Capital

- Mezzanine

- Hedge Fund

- Corporate

- Sovereign Wealth Fund

- Pension Fund

- Business Development Company (BDC)

- Small Business Investment Company (SBIC)

- Family Office

- Merchant Bank

- Debt Capital

There are currently 4,929 firms covered by these categories in TagniFi. Here are the number of active private equity firms by state:

| Rank | State | PE Firms |

| 1 | New York | 869 |

| 2 | California | 751 |

| 3 | Texas | 282 |

| 4 | Illinois | 257 |

| 5 | Massachusetts | 236 |

| 6 | Connecticut | 142 |

| 7 | Florida | 137 |

| 8 | Pennsylvania | 88 |

| 9 | Colorado | 81 |

| 10 | Georgia | 80 |

| 11 | North Carolina | 72 |

| 12 | Maryland | 55 |

| 13 | Michigan | 53 |

| 14 | Minnesota | 49 |

| 15 | Ohio | 48 |

| 16 | Tennessee | 46 |

| 17 | Virginia | 45 |

| 18 | Washington | 43 |

| 19 | District of Columbia | 42 |

| 20 | Missouri | 42 |

| 21 | New Jersey | 39 |

| 22 | Utah | 36 |

| 23 | Wisconsin | 22 |

| 24 | Indiana | 20 |

| 25 | Arizona | 17 |

| 26 | Kansas | 17 |

| 27 | South Carolina | 16 |

| 28 | Louisiana | 13 |

| 29 | Oregon | 11 |

| 30 | Iowa | 10 |

| 31 | Alabama | 9 |

| 32 | Delaware | 9 |

| 33 | Nebraska | 7 |

| 34 | New Hampshire | 7 |

| 35 | Arkansas | 6 |

| 36 | Kentucky | 6 |

| 37 | Nevada | 6 |

| 38 | South Dakota | 5 |

| 39 | New Mexico | 4 |

| 40 | Maine | 3 |

| 41 | Oklahoma | 3 |

| 42 | Rhode Island | 3 |

| 43 | Mississippi | 2 |

| 44 | Montana | 2 |

| 45 | Hawaii | 1 |

| 46 | North Dakota | 1 |

| 47 | Wyoming | 1 |

| 48 | Alaska | 0 |

| 49 | Idaho | 0 |

| 50 | Vermont | 0 |

| 51 | West Virginia | 0 |

The TagniFi Investors database is a powerful tool for identifying financial buyers by their stated investment criteria including, size preference, industry focus, geographic focus, and more. In addition, you can search for private equity firms with existing portfolio attributes such as keyword or industry classification which makes it easy to find potential buyers for add-on opportunities. Every investor has a full profile including investment criteria, team bios, current and exited portfolio companies, news, deals, advisors, and more.