The modern financial data platform for foundations.

9,000+ Public Companies

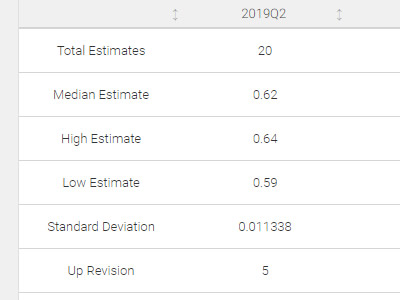

4,000+ Analyst Estimates

800,000+ Economic Time Series

50,000+ Public and Private M&A Deals

Advanced Valuation Tools for Foundation Portfolios

TagniFi's advanced financial data technology provides you with an affordable, all-in-one solution that makes the investment process more profitable.

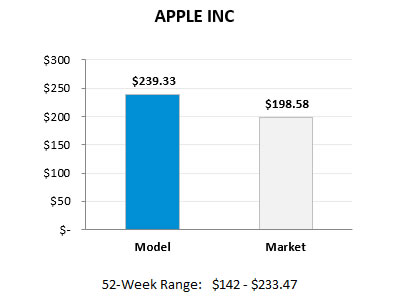

Instantly calculate the intrinsic value of a company's stock and change forecast scenarios to stress test your valuation on the fly.

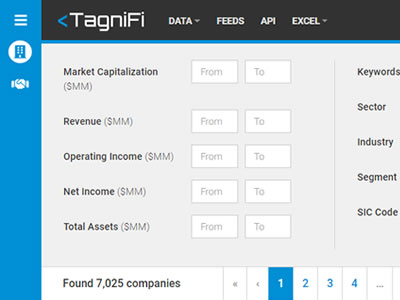

COMPANY SCREENER

Search for public companies by valuation, keyword, SIC code, financials and more. Easily take your analysis to Excel by copying tickers with one click.

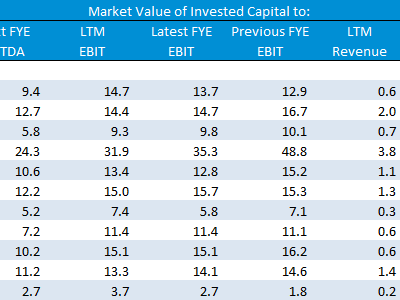

TRADING COMPS

Easily compare relative valuations in a peer group to identify long and short opportunities for your clients' portfolios.

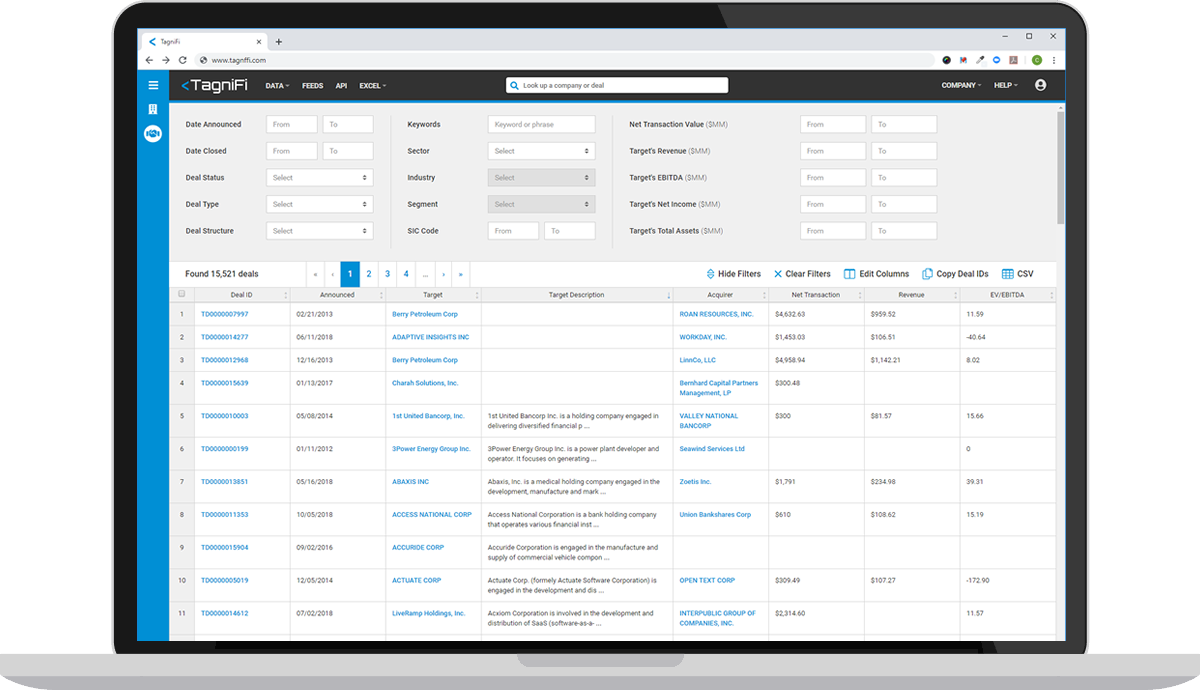

TagniFi Console

The TagniFi Console is a web client for searching and analyzing companies, deals and more. Easily take your analysis to Excel by copying tickers and deal IDs with one click.

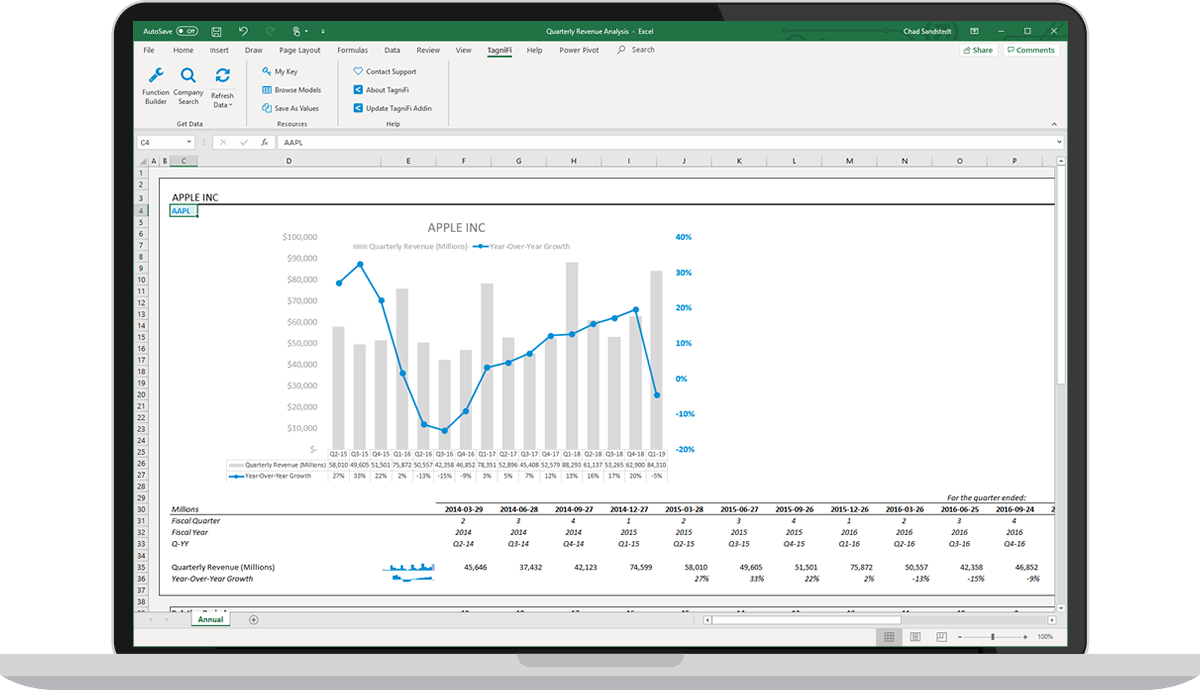

TagniFi Excel Plugin

The TagniFi Excel plugin streamlines your investment process. Simply enter the ticker symbol to run your DCF valuation and financial analysis in Excel.

Portfolio Management Tools for Better Insights

In addition to all of the data, TagniFi has the extra tools you need to make your foundation's investment process more efficient.

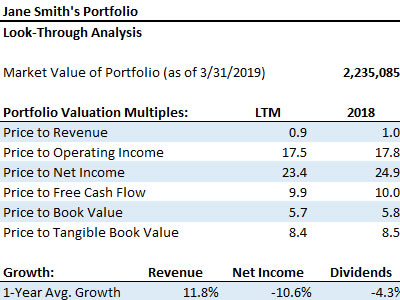

PORTFOLIO LOOK-THROUGH ANALYSIS

Calculate a portfolio’s share of each holding’s revenue, income and equity. Rolls up to a portfolio-level view of the revenue and income it is generating.

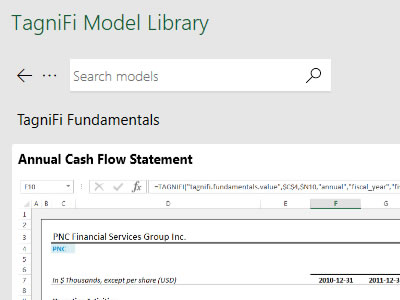

EXCEL MODEL LIBRARY

Get started with over 3 dozen Excel models for analyzing companies. Simply enter a ticker and the models update with the company's data.

FORWARD VALUATION MULTIPLES

Calculate forward multiples for your portfolio. Estimates are available for revenue, EBITDA and EPS.