By Charlie Strout

In our previous two posts, Part 1: Are 25% of S&P Companies at a High Risk of Bankruptcy? and Part 2: 80% of S&P 500 Companies See Rise in Bankruptcy Risk in Q2, we dove into the Altman Z-Score and the alarm bells that its creator, Edward Altman, has been sounding. The New York Times even ran a story that experts foresee so many filings in the coming months that the bankruptcy courts [could be overwhelmed and] struggle to salvage the businesses that are worth saving. In this month’s post, we re-evaluate the bankruptcy risk in the market and employ the Campbell, Hilscher, Szilagyi (CHS) Model as a second tool to assess corporate distress. What we see is a bifurcated picture. Some industries are doing just fine, but the pandemic is inflicting overwhelming damage on others.

First, It Is Not All About the Pandemic

Warren Buffet famously said, “It’s only when the tide goes out that you learn who has been swimming naked.” Some firms have clearly been skinny dipping. According to the New York Times, at the end of Q1 2020, “U.S. companies had amassed nearly $10.5 trillion in debt–the most since the Federal Reserve Bank of St. Louis began tracking the figure at the end of World War II.” In March, before the pandemic’s full impact, Bloomberg reported that Historic Oil Crash Exposes Energy Firms That Binged on Debt. Retail had also has had tremendous issues. RetailDive.com reported that the “ranks of distressed retailers were already challenged going into 2020” resulting in over 9,500 store closures in 2019.

But The Pandemic Is Huge

In terms of tides going out, the pandemic is a Bay-of-Fundy ebb where the water drops 56 feet and the force can stop 8,000 locomotives in their tracks. Forbes argues that the pandemic will change the way that every generation lives, but the pandemic is impacting different industries in dramatically different ways. In our previous posts, we discussed the rising level of distress and underscored the risk in REITs, energy, and hospitality. However, there is reason for concern. According to Bloomberg’s Principal Global, the percentage of firms who would not be able to cover their interest payments with last year’s earnings has risen dramatically to its current level of 18%. Yet, the market has continued to climb. As of October 23rd, the S&P 500 was UP almost 8% year-to-date. So what gives?

In two words, The Fed. The Fed committed to doing whatever it takes to support the economy, and it has done a lot. Indeed, Randal Quarles, member and vice-chair of supervision of the Federal Reserve Board of Governors, is concerned that the Fed has intervened so much in the Treasury market it may not be able to function properly without the Fed’s continued intervention. The Fed is so concerned attempting to influence fiscal policy for the first time… ever. We are not arguing here that the Fed’s intervention is just delaying a cataclysmic future or even that a cataclysm is certain. Alas, if we had that crystal ball… Rather, we are arguing that now more than ever is a time for prudent investors to use the tools at their disposal to evaluate the risk in their investments.

The Campbell, Hilscher, Szilagyi (CHS) Model

One of these tools is the Campbell, Hilscher, Szilagyi (CHS) model of distress risk which produces a probability that a firm will experience financial distress within one month, one year, and three years. The Altman Z-Score discussed in previous posts has been around since 1968, and while it is still widely used, the CHS model is one of the more recent models that have shown better predictive results. The CHS model was first introduced in 2008 and refined in a 2010 paper. The model takes a number of fundamental and market-based inputs and defines its output to include financially driven de-listings and D credit ratings in addition to bankruptcy filings. According to the paper, the broader definition of failure allows the model to capture “at least some cases in which firms avoid bankruptcy by negotiating with creditors out of court.”

For this article, we implemented the CHS model for any public company in Excel by leveraging TagniFi’s data and their handy API. (Disclosure: TagniFi is a sponsor of this article.)

CHS Inputs

- Profitability: Profitable companies do not tend to go bankrupt

- Leverage: More leverage, more risk (in general)

- Liquidity: Firms need cash to pay the interest on their debt

- Excess Returns: Firms that are currently “beating the market” are less likely to experience financial distress

- Volatility: The share price of firms close to bankruptcy are volatile

- Relative Size: Big firms are less likely to have financial distress because they are more likely to issue additional debt

For a detailed discussion please refer to the 2010 paper: Predicting Financial Distress and the Performance of Distressed Stocks.

Kicking the Tires

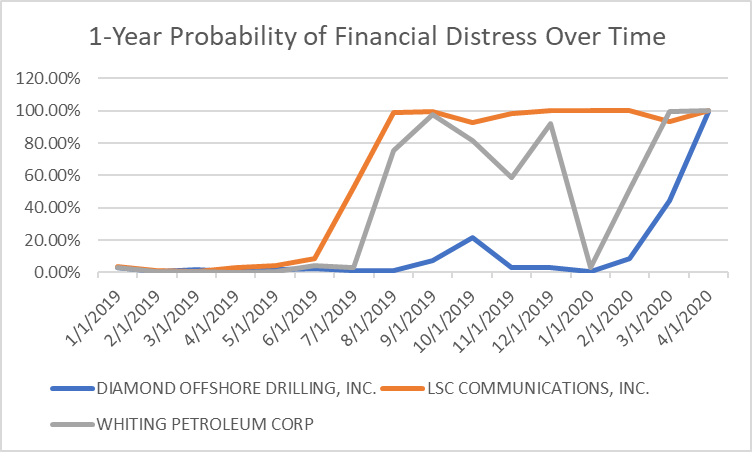

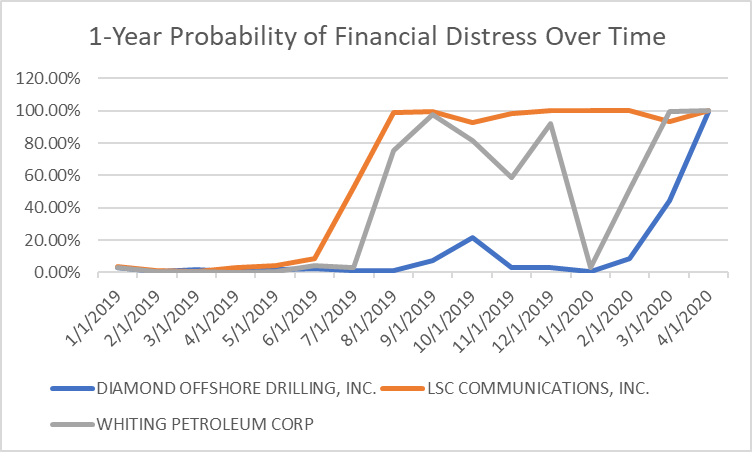

One nice thing about TagniFi’s data is that it implements a “vintage date” that makes it easy to backtest any model. When coding the CHS model into Excel we included vintage date as a parameter so that we could see what the model produced at any point in the past. Since this is our first time using the model, we decided to kick the tires on it by looking at a few firms that actually did file for bankruptcy recently: Diamond Offshore Drilling, LSC Communications, and Whiting Petroleum. All of these firms filed for bankruptcy in April 2020, and the chart below shows what the CHS model gave as the likelihood that they would experience financial distress in the next twelve months.

In each of the three cases, the model did give a prior warning about the impending implosions. In the case of LSC Communications, the model was quite clear while the model gave a more subtle hint to the pending disaster of Diamond Offshore Drilling. On October 1, 2019, Diamond had a market capitalization of over $700 million. By the following May, it was zero. Buyer beware.

Looking at Retail and the Future

Pamela N. Danziger reports in Forbes that Retail Bankruptcies Could Go From Bad To Worse In 2021. Generally, retailers tend to file for bankruptcy before Labor Day because that allows them to complete their going-out-of-business sales before Christmas,” comments David Berliner. He thinks a lot of firms on the edge are betting on a good holiday season to allow them to hold on. Danziger argues that a toxic mix of COVID-19, election uncertainty, rising unemployment, the shuttering of retail hubs like Manhattan, and the lack of a stimulus package make a good holiday season unlikely. This sets the stage for a spate of retail bankruptcies in 2021. Danziger also reminds us that “in the Great Recession that ended June of 2009, the retailer fallout peaked the year after, in 2010.” If history repeats itself, let’s look at who could be next.

| Ticker | Company | Market Cap | Probability of Distress |

| M | MACY’S, INC. | 1,916,992,000 | 4.5% |

| JWN | NORDSTROM INC | 2,032,596,000 | 6.6% |

| DXLG | DESTINATION XL GROUP, INC. | 13,561,209 | 69.0% |

| EXPR | EXPRESS, INC. | 48,684,150 | 92.2% |

| CATO | CATO CORP | 161,508,041 | 4.60% |

Other Hard-Hit Firms

In addition to retail, entertainment is getting hit hard. The model is showing that AMC Entertainment Holdings has a 64% chance of financial distress in the coming year. The firm currently has a market capitalization of over $400 million, so this is one to watch. Recently, the company has said that it may run out of cash by the end of the year.

Conclusion

We found the CHS model to be very useful when evaluating companies. If you have a TagniFi subscription, just give us a shout, and we can send you the Excel model so that you can run the analysis on any company in TagniFi’s universe. The overall thesis that we are testing is that now is a time for caution because of high levels of debt across many sectors of the market. The CHS model was a useful tool that helped us understand some of the nuances. Our research did not provide sufficient evidence to raise our overall outlook.

Data Provided by TagniFi. More at https://tagnifi.com/.

Charlie Strout is founder of Seven Shadow LLC, and independent research and consulting firm. More on Charlie can be found at https://charliestrout.com/.

DISCLAIMER: This article is for informational purposes only. Nothing in it is intended as advice to buy or sell a security.