Highlights

“Today, we’re opening up all of this tagged 10-K and 10-Q data to our clients and adding a new filing viewer in the Console to make it easy to use this tagged data in their analysis.”

Introducing TagniFi Footnotes and As-Reported

At TagniFi, we’ve built our company around tagged financial statement data. These tagged financial statements give us the ability to collect financial data with more accuracy and efficiency – and we pass the savings on to our customers with typical savings of 80% compared to our competition.

Every day we ingest hundreds of new 10-K and 10-Q filings as we collect this tagged data and turn it into our standardized Fundamentals data. To date, we’ve collected over 2 billion tags from SEC filings going back to 2009.

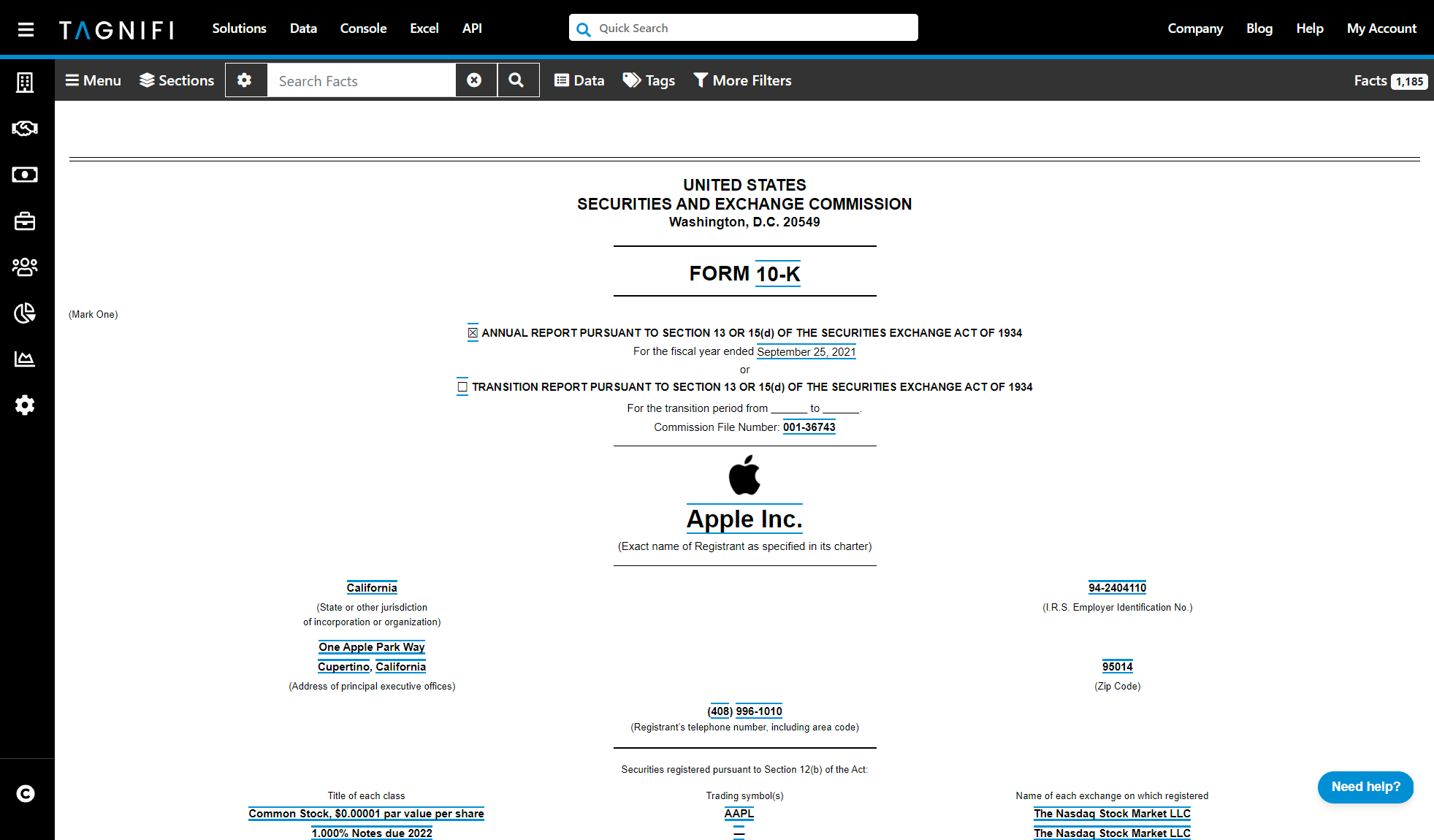

Today, we’re opening up all of this tagged 10-K and 10-Q data to clients and adding a new filing viewer in the Console to make it easy to use this tagged data in their analysis. These new features are available to clients on a Pro or Enterprise plan.

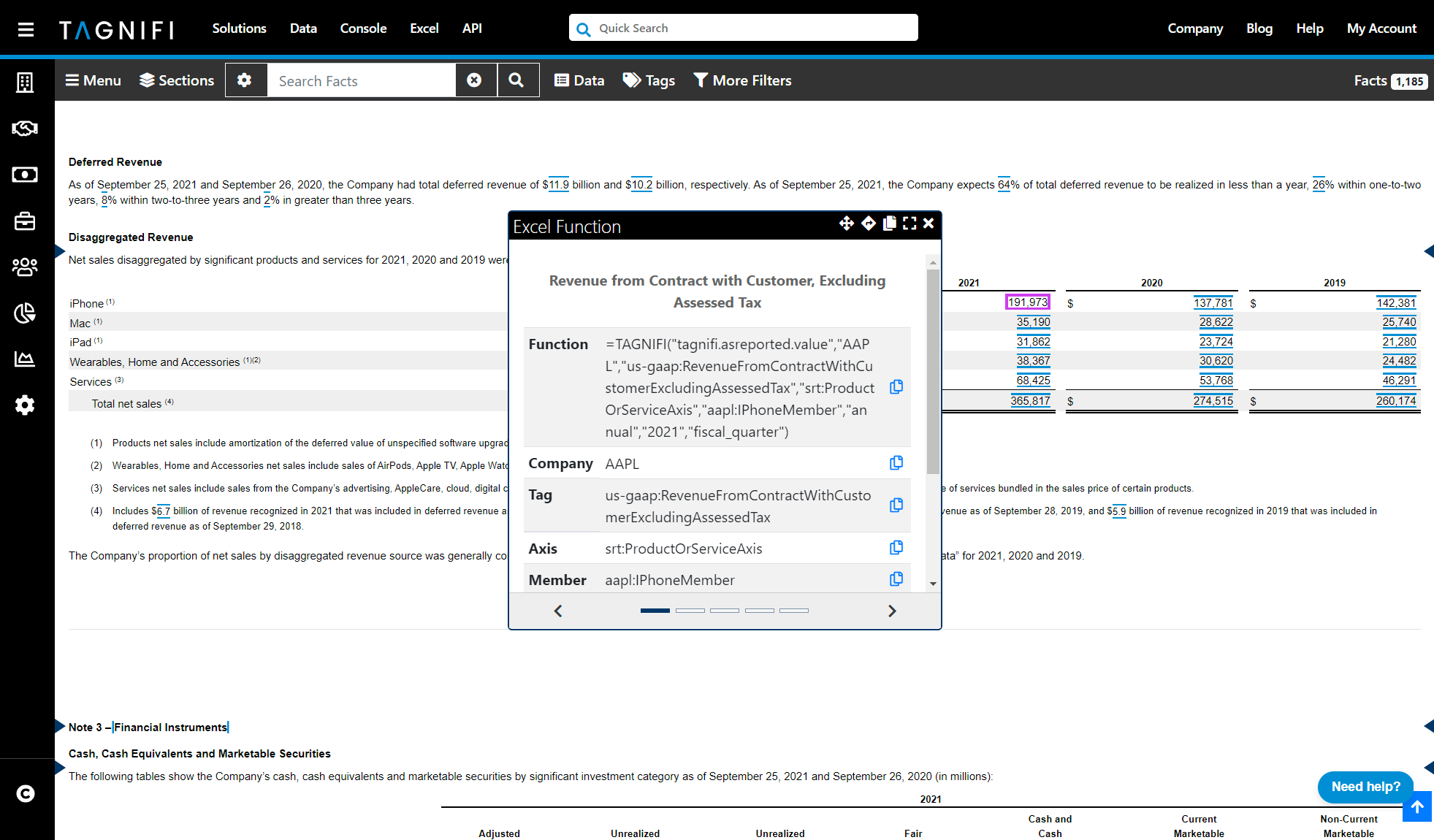

To start using this incredibly powerful footnote and as-reported data, click on any tagged item in a 10-K or 10-Q to get the Excel function for linking it to your models. For example, if you want to build a model with Apple’s revenue by product, just click on those figures in their 10-K and then copy the Excel function.

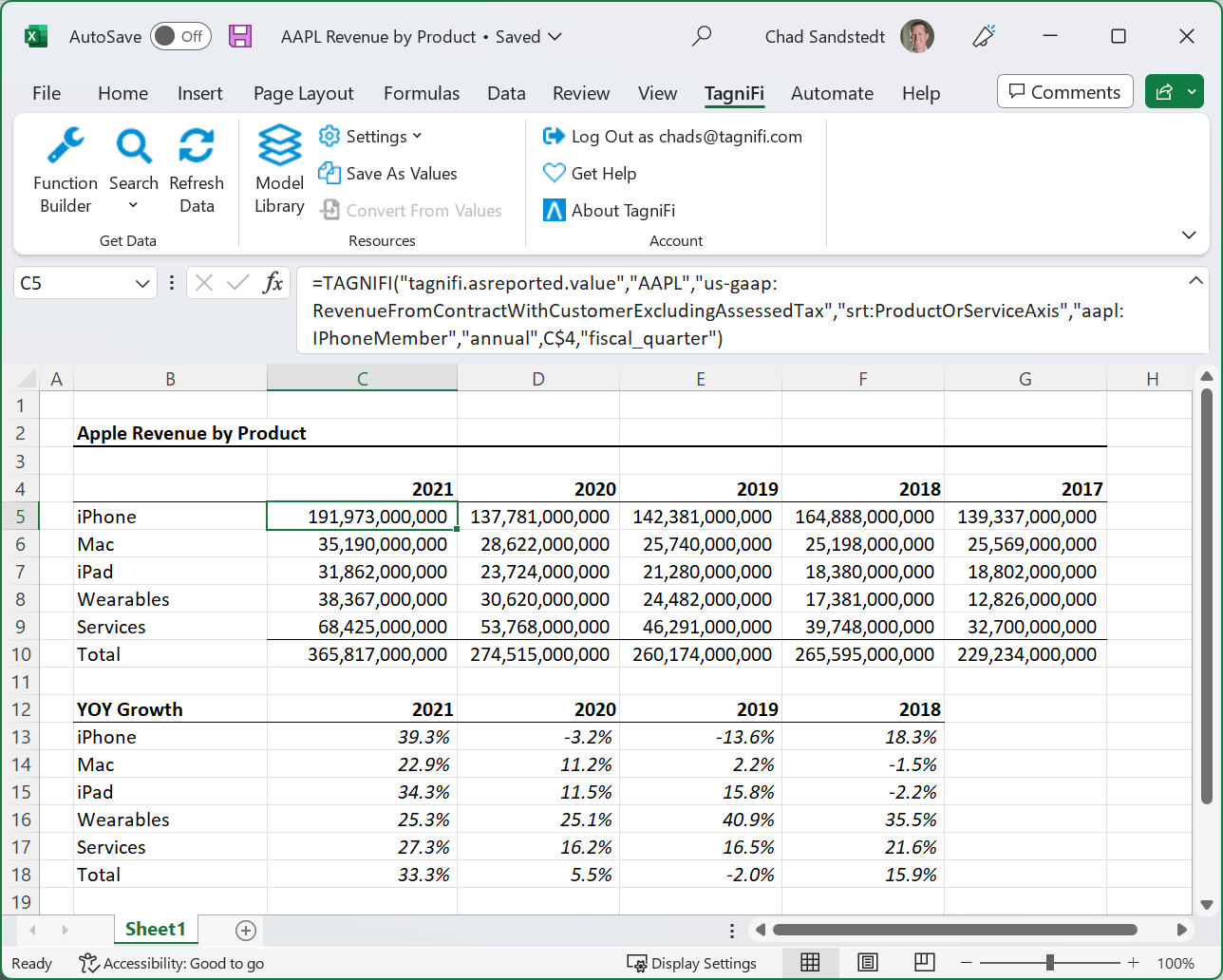

Next, simply paste the function into any Excel spreadsheet to link your model with Apple’s revenue for that product. We’ve also linked the function to a row containing years so that we can analyze trends and year-over-year growth rates.

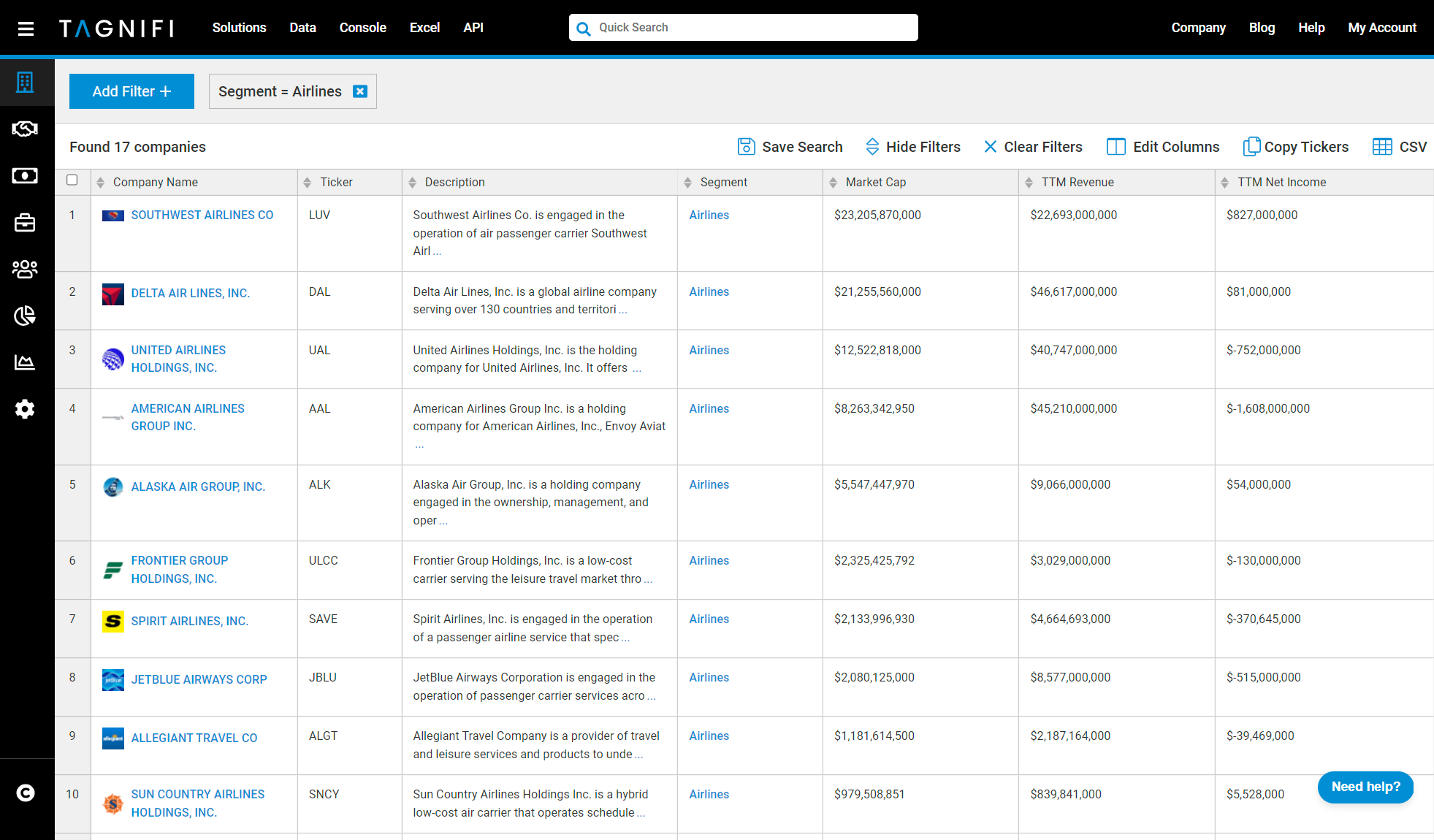

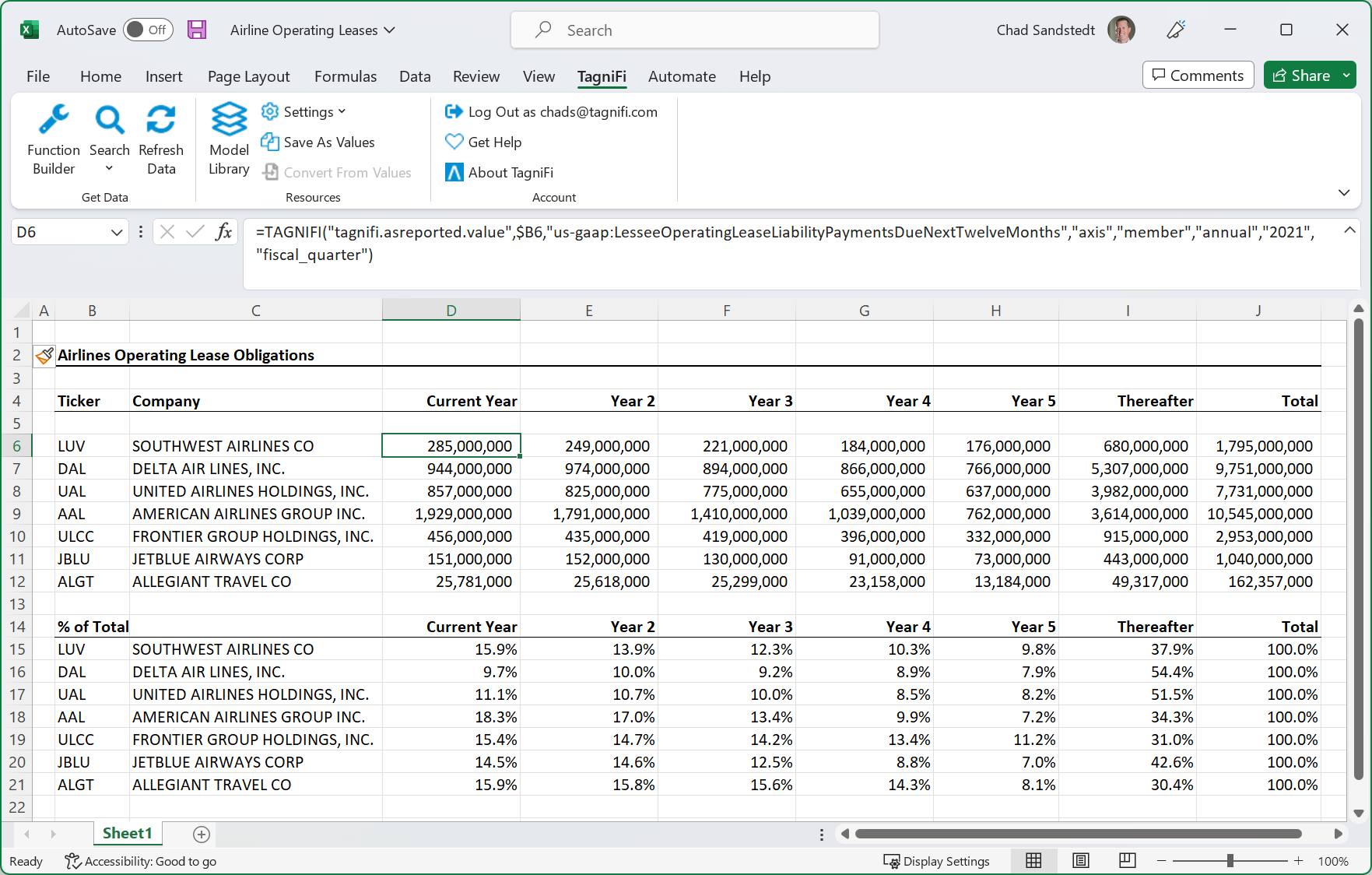

You can link any tagged item to any spreadsheet, from effective tax rates to future lease obligations, using this simple process. For example, if you want to analyze future operating lease liabilities across the airline sector, the new footnote data makes that possible with just a few clicks. First, we can run a search for all public companies with a TICS in the Airlines segment.

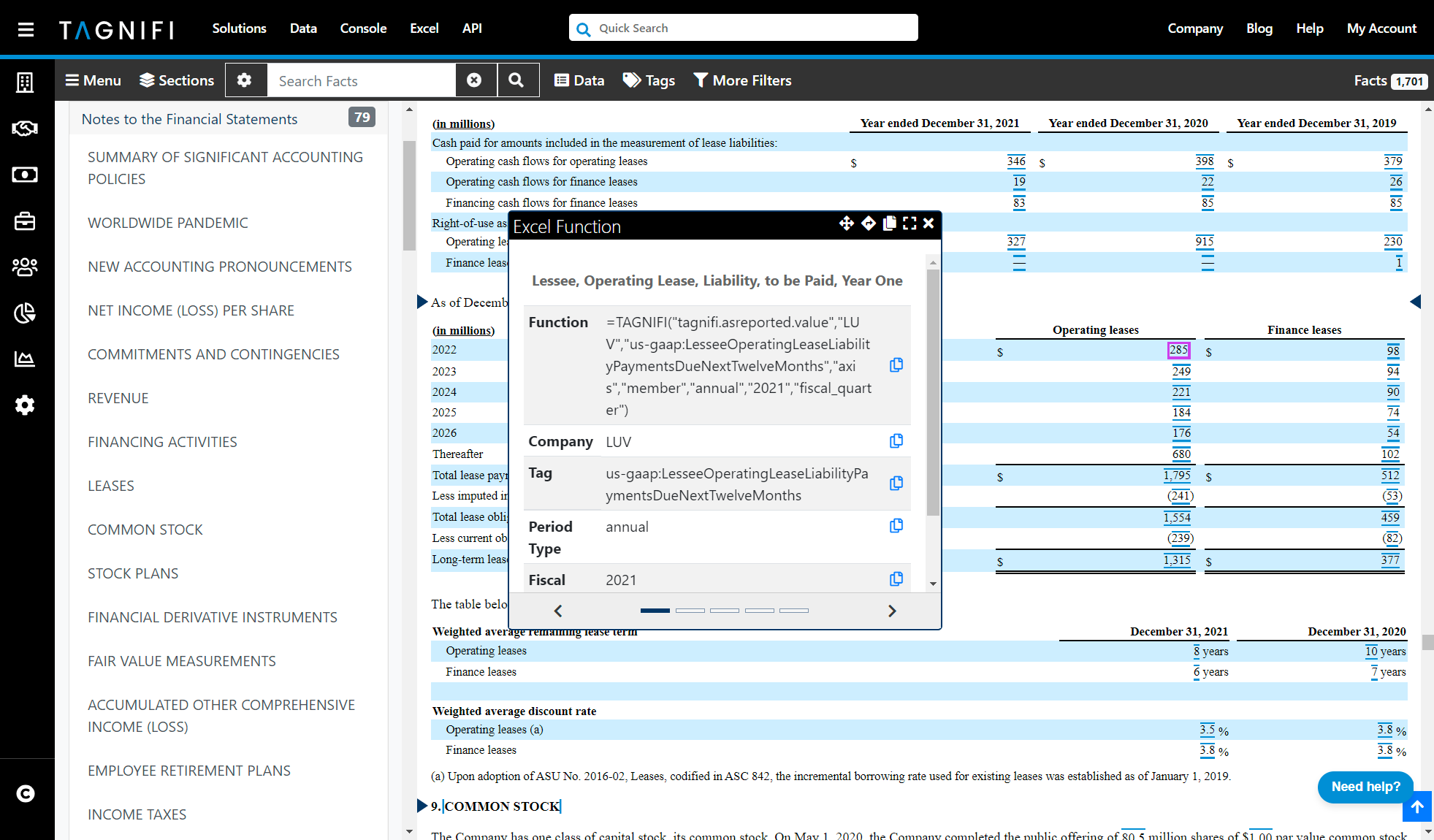

Next, we can open up a 10-K from one of the companies and navigate to the lease section of the footnotes. We then click on the items we want to link to the spreadsheet for our analysis.

Next, just paste the function into a spreadsheet and then replace the hard-coded ticker with a link to the column containing your tickers. If you drag the row down it will pull in all of the operating lease obligations by year for all of the airlines in our list.