Highlights

“The data collected through Call Reports is used to monitor individual bank performance, analyze industry trends, and inform regulatory policy decisions.”

The Federal Deposit Insurance Corporation (FDIC) has played a critical role in ensuring the stability and integrity of the US banking system since its inception in 1933. One key aspect of the FDIC’s mandate involves the monitoring and oversight of member banks’ financial health. To achieve this, the FDIC requires banks to submit periodic financial reports, known as Call Reports. In this post, we will delve into the history of FDIC Call Reports, exploring their origins, evolution, and impact on the American banking industry.

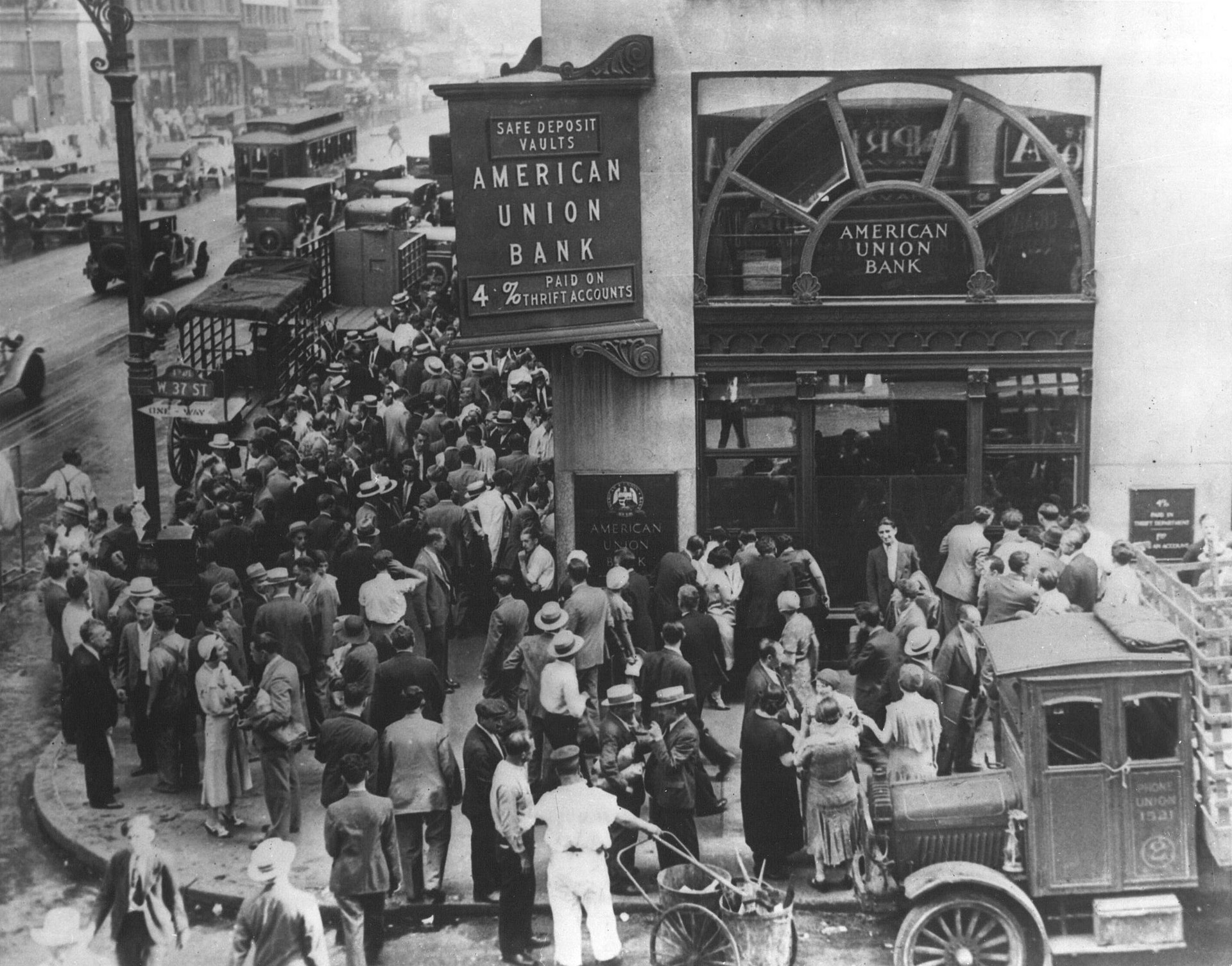

The Birth of the FDIC and Call Reports

In response to the widespread bank failures and public distrust of the banking system during the Great Depression, President Franklin D. Roosevelt signed the Banking Act of 1933, which established the FDIC. The primary purpose of the FDIC was to restore public confidence in banks by insuring deposits and closely monitoring banks’ financial health. As a part of its oversight responsibilities, the FDIC introduced the Call Report as a means for banks to regularly report their financial condition.

The Early Days: Call Reports in the Mid-20th Century

Initially, Call Reports were filed on a semiannual basis, but this changed to a quarterly basis in 1952 to provide a more up-to-date picture of banks’ financial health. The early Call Reports were relatively simple, consisting of a few key financial statements like the balance sheet, income statement, and a report on the bank’s assets and liabilities.

During this time, Call Reports were typically handwritten or typed, with banks submitting physical copies to their FDIC regional office. This manual process was time-consuming and prone to errors, but it was a crucial step in the development of a more robust banking oversight framework.

Technological Innovations and the Evolution of Call Reports

The advent of computers and advancements in data processing capabilities in the 1960s and 1970s paved the way for significant changes in the Call Report process. Banks began using software to prepare Call Reports, and the FDIC implemented electronic submission methods in the 1980s. This shift to electronic submission not only streamlined the process but also allowed for more timely and accurate analysis of the data.

In response to the changing financial landscape and the increasing complexity of banks’ operations, the FDIC has continuously revised the Call Report forms over the years. The introduction of new regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, has led to the addition of new reporting requirements and greater scrutiny of banks’ risk management practices.

Adoption of XBRL in Call Reports

The FDIC recognized the potential of XBRL to improve the Call Report process and began exploring its adoption in the early 2000s. In collaboration with the Federal Reserve System and the Office of the Comptroller of the Currency (OCC), the FDIC started the Central Data Repository (CDR) project in 2003. The CDR aimed to modernize the way regulators collect, validate, manage, and disseminate the financial data reported by banks.

The CDR officially went live in October 2005, and banks were required to submit their Call Reports using XBRL starting from the first quarter of 2006. This marked a significant shift in the way financial institutions reported their data, as XBRL’s standardized format made it easier to analyze, compare, and validate the information.

Benefits of XBRL in Call Reports

The implementation of XBRL in Call Reports has brought numerous benefits to the banking industry and regulatory agencies. Here are a few key advantages:

- Improved data quality: XBRL’s standardized format enables better data validation and consistency checks, resulting in higher-quality data for regulators and other users.

- Increased efficiency: The electronic submission of Call Reports using XBRL allows for faster processing and dissemination of data, reducing the time and resources needed for both banks and regulators.

- Enhanced comparability: With XBRL, financial data from different banks can be more easily compared and analyzed, enabling regulators to better identify trends and potential risks within the industry.

- Greater transparency: The use of XBRL facilitates the sharing of financial data with the public, promoting transparency and fostering trust in the banking system.

The Present and Future of Call Reports

Today, Call Reports are a critical tool for the FDIC and other banking regulators, providing valuable insight into the financial condition of thousands of banks across the United States. The data collected through Call Reports is used to monitor individual bank performance, analyze industry trends, and inform regulatory policy decisions.

As the banking industry continues to evolve, so too will the FDIC Call Reports. Emerging technologies, such as artificial intelligence and machine learning, have the potential to revolutionize the way financial data is collected, analyzed, and reported. While the future of Call Reports remains uncertain, one thing is clear: they will continue to play a vital role in maintaining the stability and integrity of the US banking system.

The history of FDIC Call Reports is a testament to the evolving nature of the banking industry and the importance of regulatory oversight in maintaining financial stability. From their humble beginnings in the 1930s to the sophisticated electronic reporting systems of today, Call Reports have played an essential role in ensuring the soundness of the US banking system. As we look to the future, the FDIC and other regulatory agencies will continue to adapt and innovate to address the ever-changing financial landscape.

Call Reports on TagniFi

TagniFi Pro clients have access to over 20 years of quarterly call report history for more than 5,000 private and public banks with the TagniFi Excel Add-In. To access a call report model in Excel, go to TagniFi > Model Library > Bank Analysis and select the appropriate model. Simply enter the bank ID (RSSD-ID) and the model will populate with all of the fields from the bank’s call report history.

The 031, 041, and 051 Call Report formats cater to banks with varying asset sizes and complexity.

- Form 031 is for large, complex banks with domestic and foreign offices, requiring detailed financial information.

- Form 041 targets banks with only domestic offices, providing a balance between required data and complexity.

- Form 051 is designed for smaller banks with only domestic offices, streamlining reporting by focusing on the most relevant financial data.