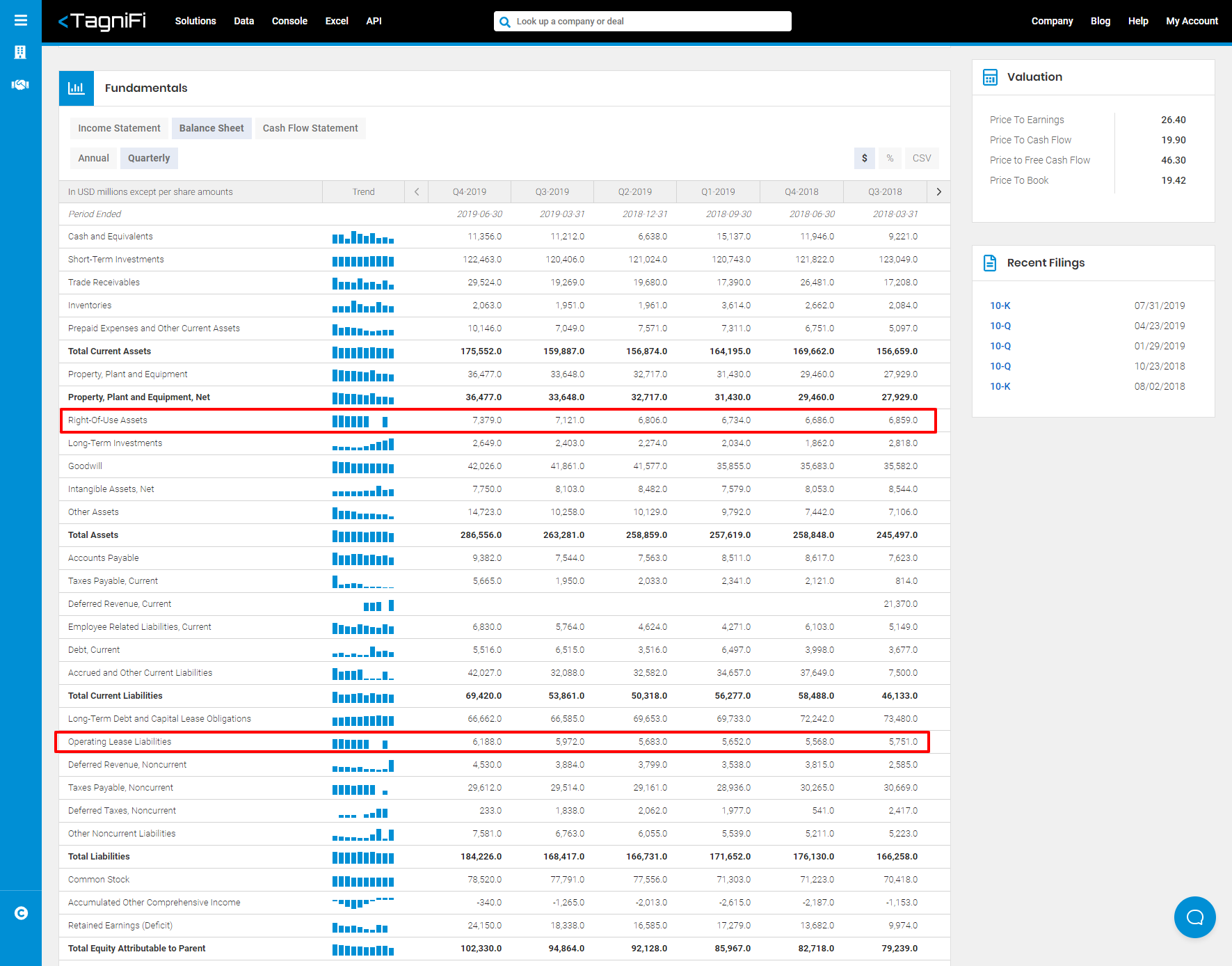

In 2016 the Financial Accounting Standards Board (FASB) issued a new standard on leases under Topic 842. One of the requirements of the new FASB standard is that public companies will be required to disclose operating lease liabilities (and their associated right-of-use assets) to the balance sheet for fiscal years beginning after December 15, 2019. We’ve reviewed the new standard and believe that new tags for these fields will be useful to our clients who desire to analyze these line items in detail. Here are the details of the new tags added to the Commercial & Industrial template under TagniFi Fundamentals:

Right-Of-Use Assets (RightOfUseAssets)

Definition: Amount of lessee’s right to use underlying asset under operating lease.

Operating Lease Liabilities, Current (OperatingLeaseLiabilitiesCurrent)

Definition: Present value of lessee’s discounted obligation for lease payments from operating lease, classified as current.

Operating Lease Liabilities, Noncurrent (OperatingLeaseLiabilitiesNoncurrent)

Definition: Present value of lessee’s discounted obligation for lease payments from operating lease, classified as noncurrent.

Should operating lease liabilities be treated as debt for my enterprise value (EV) and market value of invested capital (MVIC) calculations?

Since companies are not changing how they treat the expenses associated with operating leases (i.e. they will remain above operating income) we do not believe the new operating lease liabilities tags should be treated as debt in EV and MVIC calculations.

Will this impact how capital leases are treated in TagniFi Fundamentals?

No, capital lease obligations will continue to be included in the Long-Term Debt and Capital Lease Obligations tag.