Summary

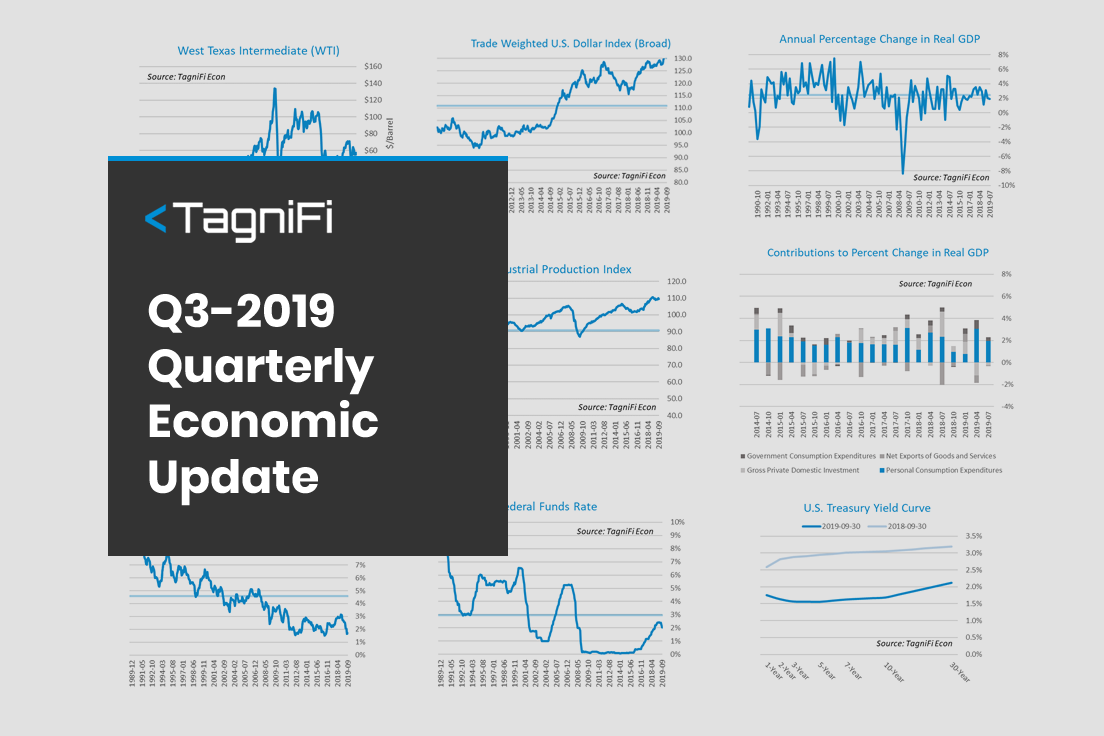

Real GDP continued to slow, but exceeded expectations in the 3rd quarter, despite concerns over ongoing trade tensions, the resulting tariffs, and shortages of skilled manufacturing labor. Personal and government spending remained robust. Additionally, the Federal Reserve has cut target interest rates twice throughout the quarter, creating favorable conditions for equity markets.

Oil prices rose slightly during the 3rd quarter as tensions mounted in the Middle East. The rising prices were moderated by growing U.S. production and stockpiles combined with decreased demand from China. Additionally, Saudi output recovered faster than expected from the mid-September oil field attack, preventing a spike in globally traded crude prices. Crude oil prices ended the quarter at $56.95 per barrel in September, up 4.0% from the previous quarter. Prices for crude oil were 18.9% lower than last September.

The U.S. dollar index continued to rise, up 2.56% from the 2nd quarter and 4.11% since the 3rd quarter last year. The dollar gained momentum in August and September as a result of weakening global economies and aggressive monetary policy easing overseas. A notable factor was a drop in the value of the British pound amid Brexit uncertainty.